The primary goal of the Affordable Care Act (ACA), or Obamacare, is to make health care affordable to all Americans, partly through the use of tax credits, or subsidies. Understanding how these subsidies work and whether you qualify could save you significant money and stress during open enrollment, at tax time and throughout the year.

Think of the premium tax credit like a discount on monthly health insurance premiums. They are available to people with incomes below qualifying levels—in other words, to those who may otherwise struggle to pay the normal price for monthly health insurance premiums.

Who qualifies for Obamacare tax credits?

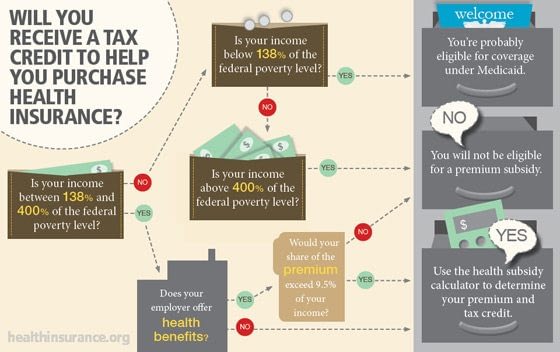

People who make between 100% and 400% of the federal poverty level are eligible for premium tax credits. The poverty level thresholds that will be used during the 2014-2015 open enrollment period are:

Household Size Poverty Level 400% of Poverty Level

1 $11,670 $46,680

2 $15,730 $62,920

3 $19,790 $79,160

4 $23,850 $95,400

5 $27,910 $111,640

6 $40,090 $127,880

How much will you get in Obamacare tax credits?

How much assistance you receive is based on how much money you make and the size of your family. But the final cost of your health insurance plan will depend on additional factors like where you live, your health and whether or not you smoke.

The ACA established maximum percentages of income that people can pay for a health care plan. Depending on where your income falls in relation to the federal poverty level, the ACA limits your health insurance premium costs to somewhere between 2% and 9.5% of your income. If a “benchmark” health care plan (the second-lowest-priced silver plan available) in your area is higher than the percentage for your income level, the tax credit you receive will make up the difference.

Here’s an example: In 2014, a single person making 150% of the federal poverty level, or $17,235 each year, would pay no more than 4% of her income, or $57, each month on health insurance premiums. For an individual making 300% of the poverty level, or $34,470, that maximum premium would be 9.5% of her income, or $273 per month. If the benchmark plan exceeds this limit, the tax credit will pick up the balance.

This tool from the Kaiser Family Foundation can help determine how much you’ll likely qualify for based on income, family size and state. You can also find this information on the ACA Marketplace or your state exchange when you make changes to your plan during open enrollment.

Getting it now vs. getting it later

There are generally two ways of the premium tax credits: throughout the year as a discount on your health insurance premiums purchased through the Marketplace, or at the end of the tax year when you file your annual income tax return.

Example: You find you qualify for $2,600 in an ACA premium tax credit. You can elect to take this credit when you file your tax return, potentially qualifying you for a greater IRS refund. On the other hand, if you choose to use it throughout the year, you’ll have approximately $217 ($2,600 divided by 12 months) applied to your health insurance premium each month, reducing the amount you pay out of pocket.

A word of warning about redeeming your tax credits

If you underestimate your income when applying for the tax credit or if your income changes during the year, you could be awarded tax credits you aren’t entitled to. If this is the case, the IRS will expect to get some of that money back when you file your tax return. In other words, you could end up owing. Look here for a guide to Obamacare and your taxes.

“Since consumers’ income may go up further than they expected during the year, it’s a good idea to check in with their exchange and advise them of any changes so that the credit can be adjusted,” says Sacha Adam, TurboTax ACA product leader.

In September, the Centers for Medicare and Medicaid Services revealed 467,000 households had “data matching issues.” That is, the data submitted when applying for ACA subsidies didn’t match what the federal government had on file. For the government, this is a red flag that people may end up having to pay back some of their advanced tax credit.

Fortunately, payback amounts are capped under the ACA. For individuals in the 2014 coverage year, your payback amount cannot exceed $1,250. For families, that cap is $2,500. Further, if your income changes for the worse, dropping below the 100%-400% poverty threshold, you won’t be required to pay overages back.

Adam suggests consumers be proactive. “One of my new favorite end-of-year tax tips is to report any income changes to the Marketplace so that they can change the amount of tax credit that is being applied to your insurance premium,” he says. “This may reduce the amount that you have to pay back.” Further, Adam adds, a change in income could qualify you for other tax deductions and credits that “may offset some of the premium tax credit you have to pay back.”

Cost-sharing subsidies: An additional way to save

Though cost-sharing subsidies are often talked about in conjunction with the premium tax credit, they are a separate matter. These subsidies lower the amount of out-of-pocket health care expenses you may have throughout the year, potentially helping you avoid medical debt.

Cost-sharing subsidies are available for people who make less than 250% of the federal poverty level. They are applied automatically when you purchase an ACA-compliant benchmark (or qualifying silver-level) plan. Consumers who qualify for these subsidies will also have an annual cap placed on their out-of-pocket costs, further helping you save.

The Obamacare premium tax credit can provide significant assistance for families that would otherwise struggle to pay health insurance premiums. By conservatively estimating your income when you apply for coverage and alerting the Marketplace when your situation changes, you can make the most out of these benefits while minimizing the potential risk of owing at tax time.

Have you checked with Marcia Da Silva about your Obamacare plan? Call her today for your free appointment and get your family covered!

Filed Under: Blog | Tagged With: Affordable Care Act, ask an advisor, health care reform, health coverage, health insurance, health insurance guide, Healthcare, healthcare information, obamacare, obamacare enrollment